Unique Info About How To Get A Small Business Loan

Ad get your small business funded fast!

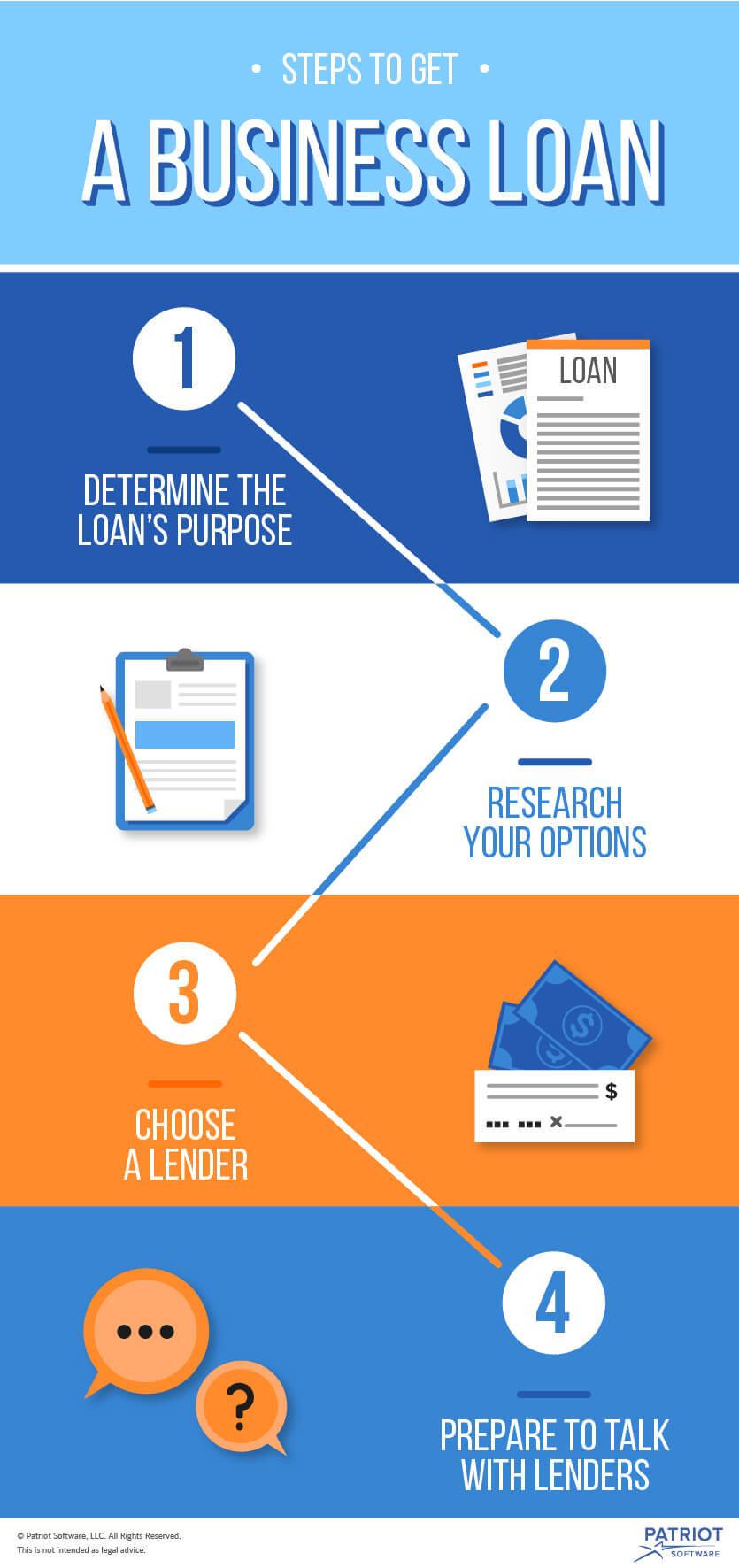

How to get a small business loan. Sba only makes direct loans in the case of businesses and homeowners recovering from a. To get a small business loan, you need to: Go to the lendingtree® official site now.

Small business owners can choose from a wide range of sba loans, business loans, and lines of credit. To get a small business loan, you must fill out an application and meet the requirements. Once you've figured out why you need to borrow money, the next step is identifying the loan amount.

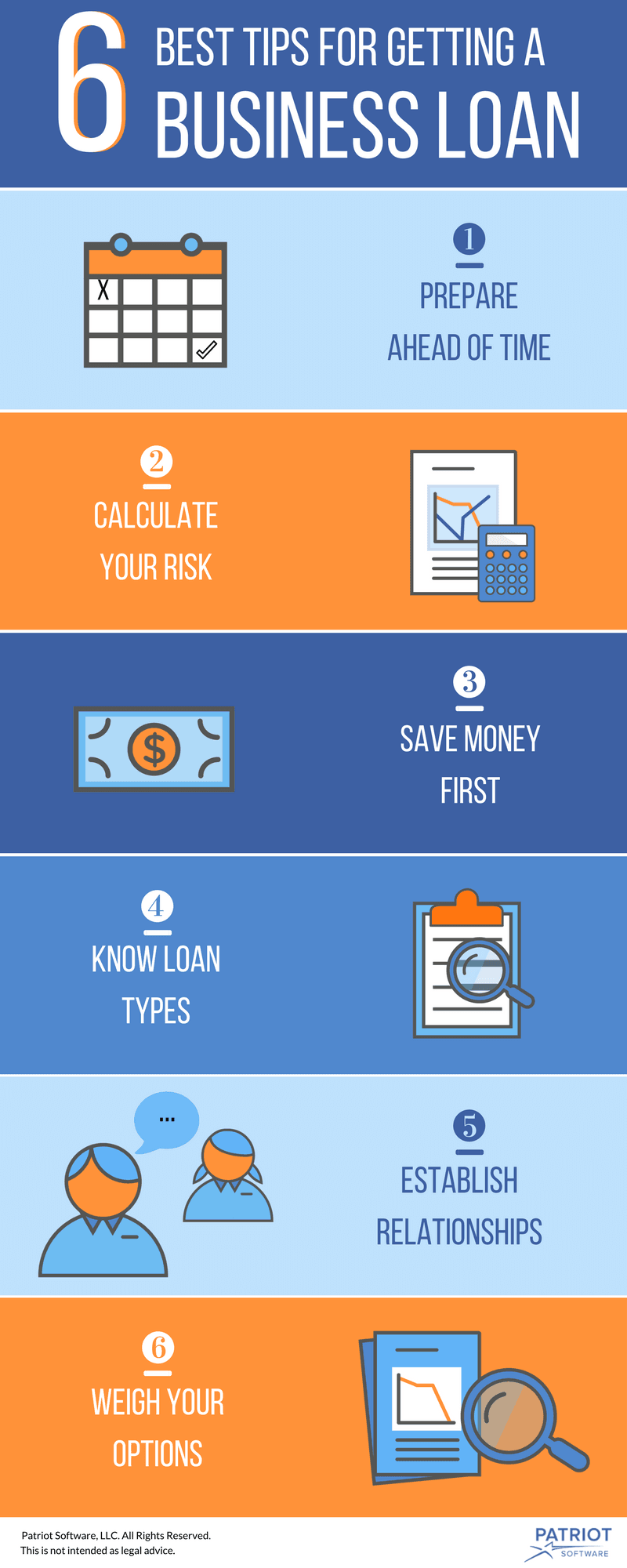

Loan term for small business loans. Lenders will make a thorough inspection of your company to determine the risk of approving the loan. As you get credit and loans, pay them off on time.

It’s important to review the terms and. If approved, get help supporting your business goals. The exact credit score you’ll need for getting a loan to buy a business varies by lender, but in general, a score of at least 680 will give you the best approval odds.

Ad get between $25k to $6m for your business. Although a small business grant and loan are both ways to get funds for your business, they operate differently. Equip your business with the tools and machinery it needs to get work done.

Over 90% of clients keep coming back for more funding, see why businesses grow with ucs You can get about $25,000 to $5 million in small business loans for a term loan. Small business administration are the most sought after because of.